As India’s industrial landscape becomes more energy-intensive and cost-sensitive, business leaders are increasingly turning to captive power plant and group captive power plant models to future-proof operations. Whether you’re running a data center, a cement plant, or a pharma manufacturing facility, securing reliable, round-the-clock, cost-effective clean energy is now a strategic imperative.

This blog breaks down the real-world economics and regulatory nuances of captive and group captive power setups in India. Backed by updated legal definitions and current market trends, it’s designed to help you make an informed, compliant investment decision. It also gives you clarity on what is captive power plant and what is a group captive project, especially in the Indian regulatory context.

For large power consumers, two proven pathways stand out:

Captive Power (self or jointly owned with an Independent Producer)

Group Captive Power

Both models enable businesses to buy power directly from a renewable energy plant—typically solar or wind – at significantly lower tariffs compared to grid power. Crucially, both offer exemption from Cross Subsidy Surcharge (CSS) and Additional Surcharge (AS) under the Electricity Act and Open Access Rules.

But the ownership, investment, and operational structures differ – and so do the strategic implications.

Three Strategic Models at a Glance

| Model |

Ownership Requirement |

Consumer Type |

Consumption Rule |

Key Advantage |

| Captive – Self-Owned |

100% ownership of the power asset |

One industrial consumer who owns its plant |

≥51% of power generated |

Full control; CSS & AS exemption |

| Captive – With IPP |

≥26% equity in SPV by consumer and rest by the Power Producer |

One large consumer |

≥51% of power generated |

Minimal CapEx; CSS & AS exemption |

| Group Captive |

≥26% equity in SPV (can be) by multiple customers + ≥51% power usage collectively |

Multiple consumers |

Each consumes part of the 51% load |

Shared ownership; CSS & AS exemption; lower entry barrier |

Subscribe to our newsletter

1. Captive – Self-Owned

Ideal for corporates that:

- Have consistent, high power demand

- Are comfortable with full CapEx investment

- Want long-term control of energy assets

How it works (a simple explanation of the captive power plant process):

- The consuming entity owns 100% of the captive power plant (or via a wholly-owned SPV)

- Must consume at least 51% of power generated annually

- Entire CapEx, O&M and asset lifecycle is managed by the business (or EPC contractors)

Strategic Benefit: Full tariff control, strongest long-term savings, and total energy independence. But comes with the burden of operating and maintaining the plant—understanding the working of captive power plants is crucial to success.

2. Captive – With an Independent Power Producer

Best suited for:

- Large industrial consumers with steady loads

- Those who prefer a low CapEx, co-development model

How it works:

- The project is developed by an Independent Power Producer (IPP)

- The consumer invests minimum 26% equity in the SPV (to qualify under the “captive” definition)

- Must consume ≥51% of power generated

- The IPP manages all technical, operational, and regulatory responsibilities

Strategic Benefit: CSS & AS savings with minimal CapEx involvement. Fast-track green power adoption without the burden of running the captive power plant itself.

3. Group Captive (Check Sunsure’s Group Captive Solutions)

Ideal for:

- Mid-sized to large companies with moderate or variable demand

- Businesses that want to avoid CapEx-heavy projects but still benefit from CSS/AS exemption

How it works:

- Multiple consumers jointly invest at least 26% in the SPV

- Collectively, they must consume at least 51% of the power

- Typically structured by IPPs who bring together a portfolio of consumers across industries

The group captive power plant model has become popular among pharma, IT, and textile companies due to its shared CapEx approach. In many cases, a group captive solar power plant offers the most viable path to sustainability without overburdening a single company.

Financial Implications

| Cost Element |

Captive/Group Captive Arrangement with Power Producers |

Discom |

| Power Tariff |

₹3.5 – ₹4.5/kWh |

₹7 – ₹10+/kWh |

| CSS (Cross-Subsidy Surcharge) |

Exempt |

Applicable |

| AS (Additional Surcharge) |

Exempt |

Applicable |

| Capex |

Min. Requirement |

None |

| ROI Period |

4–6 years (depending on model) |

Loss in long run |

Regulatory Compliance: Don’t Cut Corners

While CSS and AS exemptions make these models financially attractive, they come with stringent compliance requirements:

- Metering and Scheduling: SLDC-approved energy accounting and open access procedures.

- Shareholding Audit: Regulators can demand shareholder data and power draw audit at any time.

- Consumption Proof: Demonstrating 51% power offtake is mandatory every year to retain benefits.

These rules are applicable to both captive power plant and group captive power plant models. Businesses looking for captive power plant examples can study the strategies of companies in cement and steel, where ownership and usage audits are crucial to compliance.

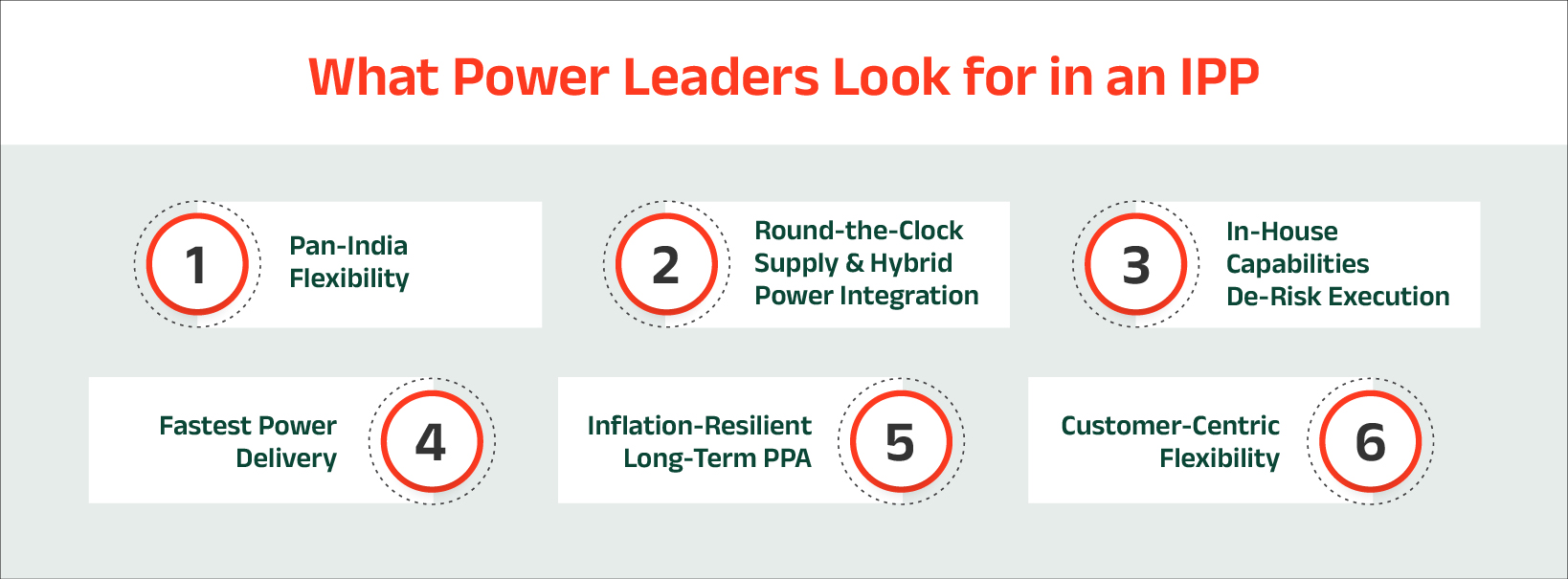

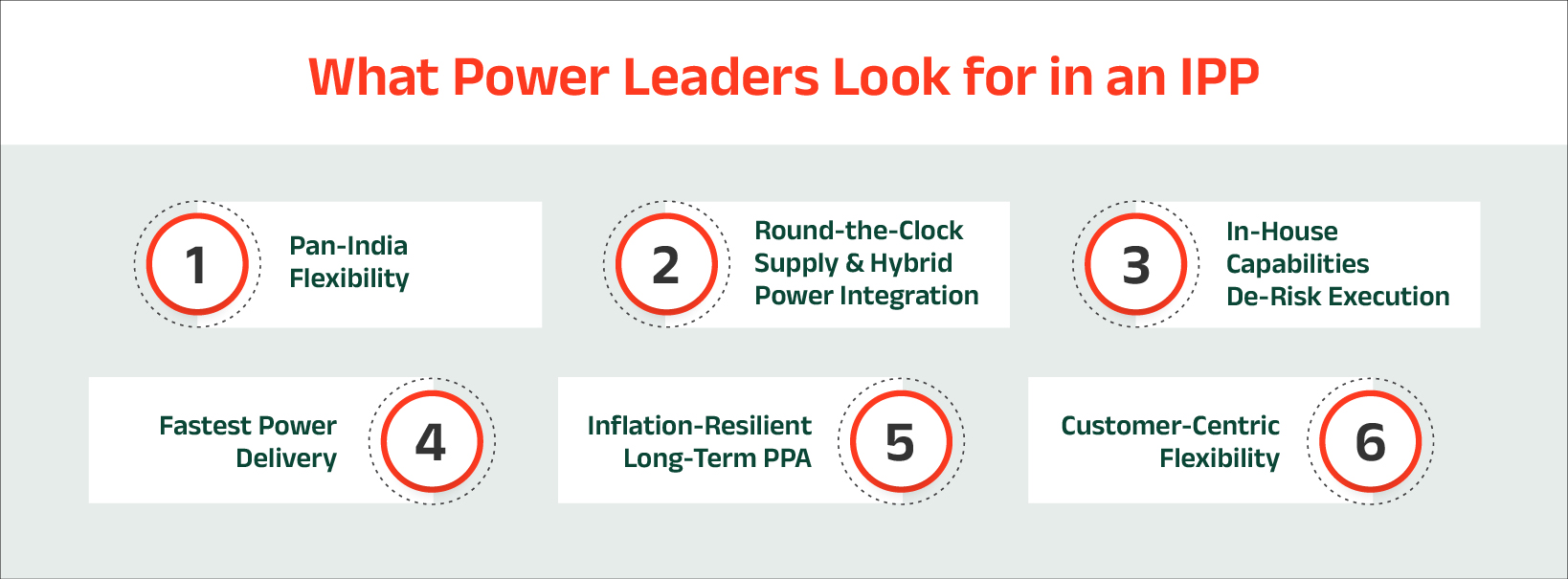

How India’s Power Leaders Choose the Right Model

For businesses with large, consistent power loads—like data centers, cement plants, iron & steel, metals and chemicals (the commercial and industrial sector)—partnering with the right IPP unlocks maximum value.

- Pan-India Flexibility

Choosing an IPP with both intrastate and interstate project capabilities ensures access to the most cost-efficient RE corridors across India. This flexibility lowers landed cost and hedges against future grid constraints.

- Round-the-Clock Supply & Hybrid Power Integration

With grid demand peaking across day and night cycles, RTC power is no longer a luxury—it’s a necessity. IPPs that offer hybrid RE portfolios (solar + wind + storage) can help you displace the largest share of grid power, pushing your RE penetration toward 80–90%.

- In-House Capabilities De-Risk Execution

IPPs with internal capabilities across project development, financing, regulatory, and O&M drastically reduce execution risk. You avoid fragmented vendors, delays, and compliance lapses—which directly translates to faster commissioning and fewer liabilities.

- Fastest Power Delivery

The faster your plant is commissioned, the sooner you start saving. A best-in-class IPP can activate supply in 4–6 months versus 10+ months for less experienced developers. That’s millions saved in avoided grid tariffs and diesel backup.

- Inflation-Resilient Long-Term PPA

Signing a 15–25 year PPA at a fixed tariff shields your business from tariff hikes, fossil fuel volatility, and shifting state regulations. Energy becomes a predictable OPEX, not a variable cost center.

- Customer-Centric Flexibility

The right IPP is more than a supplier – they become a business’ strategic energy partner. Look for one that tailors project structure, location, PPA complexities, and hybrid mix to your exact operational needs.