Table of content

- Understanding the Steel Industry's Carbon Footprint

- The Concept of Net-Zero Emissions

- Green Energy Solutions for the Steel Industry

- Government Incentives and Regulations

India is the 2nd largest steel producer in the world. Steel production accounts for 10% to 12% of the country’s emissions. The steel industry contributes to about 2% of India’s GDP and employs around 28 lakh people directly and indirectly.

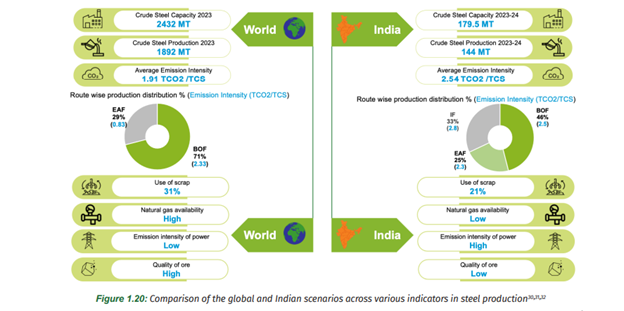

The average CO2 emission intensity of the iron and steel industry has reduced from 3.1 tCO2/tcs in 2005 to around 2.55 tCO2/tcs by 2022. As India aims to raise its steel production capacity to 300 million tons per annum by 2030, it is important to adopt green steel production to control the industry’s contribution to greenhouse gas emissions.

India aims to achieve net zero emissions by 2070, and green steel production will be important for achieving this goal. In this blog, you will learn how steel decarbonisation can reduce the industry’s emissions.

As per the International Energy Agency, CO2 emissions from the iron and steel industry have increased over the past decade. The World Economic Forum states that steel production accounts for 8% of CO2 emissions worldwide.

In India, Basic Oxygen Furnaces (BOF) account for around 46% of steel production, while Electric Arc Furnaces (EAF) and Induction Furnaces (IF) account for around 25% and 33% of production respectively.

Here’s a breakdown of the emission intensity of different methods of steel production:

|

Steel Production Process |

Range of CO2 emissions intensity (tCO2/tcs) |

|

Coal-based DRI-EIF |

2.70-3.10 |

|

SynGas (Coal Gasification) based DRI-EAF |

2.50-2.90 |

|

BF-BOF |

2.20-2.60 |

|

Natural gas-based DRI-EAF |

1.40-1.60 |

|

100% scrap-based steel making via EAF |

0.55-0.65 |

|

Average emission intensity of steel production |

2.54 |

Source: Greening the Steel Sector in India: Roadmap and Action Plan

Moreover, most secondary steelmakers use coal-based direct reduced iron (DRI) as primary raw material that amplifies CO2 emissions in the environment.

Net zero is a state where the total greenhouse gas emission into the atmosphere is equal to the amount removed from it. You can read our blog if you want to know about India’s net zero goals and strategy for 2070.

However, why do we need net zero energy in the steel sector?

Steel is an energy-intensive industry and most of the power for the steel sector comes from burning fossil fuels. Burning fossil fuels releases harmful greenhouse gases into the atmosphere further amplifying climate change.

Energy accounts for 20% to 40% of steel’s manufacturing cost. As of 2022, the steel industry in India uses around 75 million tons of oil equivalent (Mtoe) for its energy needs. In 2023-24, the sector had an average emission intensity of 2.54 tCO2/tcs. This sector represents nearly 25% of the overall energy consumption within the industrial domain.

In the steel production process, carbon serves two essential purposes: as a reducing agent and to fulfil energy demands.

While India’s carbon emissions intensity stands at 2.54 tCO2/tcs, the global average stands at 1.91 tCO2/tcs. Why India’s emissions intensity much higher compared to the global average? The government has explained the difference between India’s and developed countries’ steel sector as follows:

Developed countries have already reached their peak per capita steel consumption. The global average per capita steel consumption was 219.3 kg in 2023. However, India’s per capita steel consumption is still very low at only 97.7 kg in FY 2024.

As per the National Steel Policy 2017, the per capita steel consumption must rise to 160 kg by 2030. Due to low per capita steel consumption, India’s steel sector will expand rapidly beyond 2030.

India will make significant investments in Greenfield projects whereas developed countries will see limited investments.

Developed countries have a higher share of scrap in total steel production compared to India.

Natural gas is expensive in India, but in developed countries, it is a lot more affordable.

Integrated steel plants (ISPs) use coal-fired thermal power facilities, which have a much higher emissions intensity compared to less carbon-intensive grids found in developed nations.

India has low-grade coal and iron ore. Using these increases energy consumption and emissions.

Source: Greening the Steel Sector in India: Roadmap and Action Plan

To conclude, due to a lack of affordable choices, the Indian steel sector relies heavily on coal-fired blast furnaces and rotary kilns for steel production. As a result, India’s carbon emissions from the steel industry are considerably greater than the global average.

Further, one of the main goals of the Paris Agreement 2015 is to limit the rise in global temperature to 1.5°C. The UN says that the world needs to achieve net zero by 2050. India is a party to the Paris Agreement.

There is no fixed definition for green steel globally. India became the 1st country to define green steel by releasing the Taxonomy of Green Steel in December 2024.

India defines green steel as per percentage of greenness. The greenness of steel shows the extent to which the emissions intensity falls below 2.2 tons of CO2 per ton of finished steel (it is expressed as t-CO2e/tfs). Steel with an emission intensity higher than 2.2 t-CO2e/tfs does not qualify as green steel.

Further, the government unveiled the following star-rated grading system:

The rating system will be reviewed every 3 years. The National Institute of Secondary Steel Technology (NISST) will be responsible for the measurement, reporting, and verification (MRV) of green steel and issuing certificates for it.

The Ministry of Steel published a report, “Greening the Steel Sector in India: Roadmap and Action Plan”, as per the recommendation of 14 task forces set up by the Ministry. From the report, here are some key points for steel decarbonisation in India:

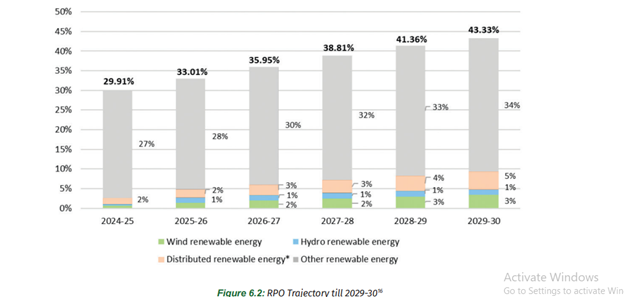

Using renewable energy, we can reduce emissions without any changes in the current steel production systems. In this context, it is important to know about Renewable Purchase Obligation (RPO).

RPO is a regulatory requirement that mandates electricity distribution companies (DISCOMs) and similar organizations to acquire a certain share of their electricity from renewable energy sources. State Electricity Regulatory Commissions (SERCs) set the RPO target for the respective states.

The Ministry of Power has set a Renewable Purchase Obligation (RPO) target of 43.33% by FY 2030 from 24.6% in FY 2023.

Source: Greening the Steel Sector in India: Roadmap and Action Plan

To meet the RPOs, steel companies in India will have to find ways to procure renewable energy (RE) apart from the share of RE they are getting from the grid. They can set out to this via multiple ways:

In captive power generation, an industrial unit generates its own power instead of relying on a grid. It is one of the significant sources of power generation in India’s steel sector.

Captive power generation can be divided into 2 categories:

In a self-owned captive renewable energy plant, the industry has 100% equity. A company with a self-owned captive plant must pay a cross-subsidy surcharge (CSS) and an additional surcharge (AS) as determined by the government.

A steel plant has at least 26% equity in a third-party captive renewable energy plant. Moreover, the steel plant must consume at least 51% of the electricity produced annually.

One of the advantages of third-party captive renewable energy plants is that the consumers are exempted from paying cross-subsidy surcharge and an additional surcharge in some states.

Energy produced by a third-party captive renewable energy plant is cheaper than thermal power and can reduce energy bills by up to 30% to 40%. It helps in steel decarbonization and the achievement of net zero emissions.

Renewable energy producers like Sunsure are leading the way in helping the steel industry produce green steel via third-party captive renewable energy.

In this arrangement, a Power Purchase Agreement (PPA) is established between the energy consumer and an Independent Power Producer (IPP). The consumer compensates the RE developer according to the tariff outlined in the PPA.

In this approach, the consumer does not need to make any upfront capital investment. The IPP manages the installation, maintenance, and operation of the power plant, relieving the consumer of these tasks. Through third-party open-access PPAs, companies can obtain fixed-rate green energy at competitive prices for extended periods. This approach helps shield them from the fluctuations commonly seen in traditional energy markets.

By utilizing these agreements, businesses can lower their operational expenses, reduce their carbon emissions, and support India’s goals for renewable energy and environmental sustainability. Since power from third-party open access mode is more affordable than energy from fossil fuels, it can reduce power costs by up to 30% to 40%. For the best results, you must rely on trustworthy brands with a proven track record like Sunsure Energy.

Green Day Ahead Market (GDAM) and Green Term Ahead Market (GTAM) allow procurement of green energy through power exchanges. Industrial consumers have the option to acquire renewable energy (RE) through power exchanges like IEX, PXIL, and HPX. Purchasing RE via the power market offers several benefits such as no necessity for capital investment. It allows consumers to take advantage of lower market-driven RE prices when available.

56% of the emissions in the steel sector can only be reduced via CCUS. The key challenge in capturing CO2 reducing the cost of capture to less than $20/ton of CO2 from $45-60/ton of CO2. However, currently, there is no clear policy framework for CCUS.

Green hydrogen can substitute fossil fuels in blast furnaces and gas-based shaft furnaces. It can also be used to produce 100% hydrogen-based DRI. In shaft furnaces, green hydrogen can replace 60-70% of the total gas consumption. This can also reduce the emissions intensity of steel by about 340 kg CO2/ton of crude steel.

Biochar is made from biomass that can replace coal and coke in steel production. It can reduce emissions by up to 1.19 tons of CO2/ton of crude steel. Leading companies such as Tata Steel, JSW, and NTPC are using biochar on an experimental basis for iron and steel production.

As per a government response in the Lok Sabha in July 2024, the government has taken the following steps for promoting green steel:

The Ministry of Steel calls renewable energy a “low-hanging fruit” for reducing emissions from the steel sector. As India aims to increase its per capita steel consumption to 160 kg by 2030, it is important to focus on producing green steel. Steel decarbonisation will help India to achieve its international climate change commitments.

IPPs such as Sunsure can play an important role in decarbonizing India’s steel sector. Its renewable energy assets stand at 500 MW. It currently has 2.5 GW of renewable energy under construction and aims to have a capacity of 5 GW by the end of 2028. Sunsure owns over 11 GW of renewable energy assets globally.

With its proven track record, it is one of the leading players in the field of renewable energy production. Companies like Sunsure can help reduce CO2 emissions by millions of tons annually and reduce power bills by up to 50%.

One of the important steps for steel decarbonisation is using clean and renewable energy in steel production. For this, we can promote CCUS, and use natural gas to produce DRI.

If the steel sector gets 43.33% of its energy from renewable sources by FY 2030-31. It will reduce the emissions of the industry by 8% from 2.54 tCO2/tcs in 2023 -24 to 2.35 tCO2/tcs in 2030-31.

Steel decarbonisation leads to lower emissions which result from the steel production process. This lowering of the emissions helps in achieving net zero.

Using green energy in the steel factories can reduce the electricity bills which steel manufacturers pay.